Thousands of Nigerians have been plunged into financial chaos following the alleged collapse of CBEX, a digital investment platform accused of swindling over N1.3 trillion from investors in what many now describe as yet another massive Ponzi scheme.

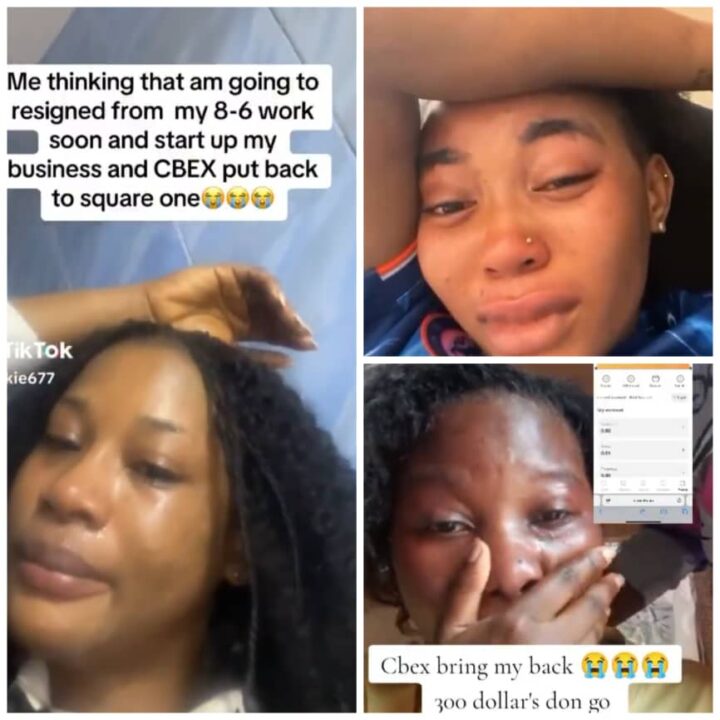

Reports began surfacing on Tuesday via YouDonHear Online, showing emotional scenes of distraught victims—many of them women—breaking down in tears after reportedly losing life savings to the platform.

According to multiple user testimonies, CBEX abruptly became inaccessible after users started experiencing delays in withdrawals. Shortly after, many discovered their account balances had mysteriously dropped to zero.

On X (formerly Twitter), users have flooded the timeline with reactions ranging from sorrow to scathing criticism.

“Even pipul wey no get anything to do with CBEX dey cry too… 9ja don tire person to the extent person nor know who dey lie again. Chai,” tweeted @edoPeekeen, capturing the widespread despair and confusion.

User @Eskimoh_ emphasized the need for better financial education:

“No one rule of investment states, ‘Never invest any amount you can’t afford to lose.’ A lot of people need financial literacy, and the sad story is the government will never add that to school subjects.”

But not everyone shared the same sympathy.

“Nigerians don’t learn,” wrote @ricky_chiekezie.

“Trust me, if another platform kicks off right after the CBEX collapse, Nigerians will still flood in like idiots. The level of greed, foolishness and gullibility amongst you people needs studying.”

Some directed their criticism at victims who posted emotional videos online.

“I don’t feel for anyone who records themselves while crying… If she like make she cry till tomorrow, na her sabi!” wrote @victorajibade10.

And in a biting tone, @kingleke34 added:

“Don’t cry eh, more Ponzi are coming.”

Others reflected on deeper lessons about risk and financial planning.

“If managing wealth were that easy, wealth management firms wouldn’t exist,” said @DSegaj.

“Yes, investing is key to sustaining wealth – but without a good financial advisor, you might lose everything to naivety.”

One Lagos-based forex broker, RHI O.O.BI, known online as @Obobanj, has been linked to the CBEX platform. In a tweet, he noted:

“While investigations are still unfolding, social media has been flooded with heartbreaking stories, outrage, and bitter lessons from victims and observers alike.”

He further echoed warnings from regulatory authorities:

“The Central Bank of Nigeria (CBN) has long warned citizens about the dangers of Ponzi schemes. Despite this, platforms like CBEX keep popping up, luring people with fake promises and vanishing into thin air.”

CBEX had marketed itself as a high-yield investment opportunity, guaranteeing a 100% return within 30 days, with investments accepted strictly in U.S. dollars.

Efforts to contact CBEX or any of its representatives have so far proven futile. Financial experts are now urging Nigerians to exercise extreme caution and verify the regulatory status of any investment platform through the CBN and Securities and Exchange Commission (SEC) before parting with their money.

For now, the full scope of financial damage may take weeks to assess, but the emotional and economic toll is already clear.